Types of Schema Markup for Financial Services

Financial services must use all tools available to enhance their digital footprint in the Digital Age when online presence is decisive for business success. Among these, SEO is paramount, especially when it comes to the implementation of schema markup. This article examines several types of Schema Markups specifically tailored for Financial Services, highlighting their importance in improving Search Engine Optimization efforts. Here, we explore how each type of schema markup can transform your online visibility and attract the right audience.

1. Why Financial Services Need SEO

1. Why Financial Services Need SEO

In the fast-evolving digital landscape, SEO is vital for financial services, a sector traditionally reliant on reputation and trust. This importance stems from the internet becoming the primary resource for financial information and services. Effective SEO strategies ensure these services appear prominently in search engine results, which is crucial for attracting potential clients. It’s not just about visibility; it’s about being found by the right audience. SEO helps target users actively searching for financial advice, investment opportunities, or banking services.

Moreover, a strong SEO presence builds credibility. When a financial service ranks high on search engines, it implicitly earns a trust badge, as users often perceive top results as more reliable. Furthermore, SEO isn’t static; it involves constant adaptation to changing algorithms and user behaviors, ensuring financial services remain competitive and relevant. Thus, investing in SEO is not a luxury for financial institutions but a necessity to thrive in the digital age.

2. Bank and Credit Union Schema Markup

Schema markup for banks and credit unions is a powerful SEO tool that enhances online visibility and user experience. This specialized markup language helps search engines understand and display detailed information about these financial institutions, including services offered, branch locations, and customer reviews. When a bank or credit union implements schema markup on their website, it allows for rich snippets in search results. These rich snippets can display a wealth of information on the search results page, from interest rates to loan details, making it easier for potential clients to find relevant information quickly. This direct approach not only improves click-through rates but also establishes a sense of trust and authority in the digital space. Furthermore, schema markup assists in local SEO, helping institutions rank higher in location-based searches. Schematic markup is an indispensable asset for banks and credit unions looking to stand out in a crowded digital landscape.

Here you can find an example of BankorCreditUnion schema markup code in JSON-LD format:

<script type=”application/ld+json”>

{

“@context”: “http://schema.org”,

“@type”: “BankOrCreditUnion”,

“name”: “XYZ Bank”,

“description”: “Leading Global Bank.”,

“image”: “https://www.xyzbank.com/images/bank.png”,

“logo”: “https://www.xyzbank.com/images/logo.png”,

“url”: “https://xyzbank.com”,

“telephone”: “+1 XXX-XXX-XXXX”,

“address”: {

“@type”: “PostalAddress”,

“streetAddress”: “Street, Number”,

“addressLocality”: “Town”,

“postalCode”: “Postcode”

}

}

</script>

If you need more fields in schema markup, you can check Schema.org’s source.

3. FinancialProduct Schema Markup

The Financial Product Schema Markup is a critical element in SEO for financial services. It allows these institutions to present detailed information about their financial products, like insurance, loans, mortgages, or investment plans, directly in search results. By using this markup, financial services can highlight key features of their products, such as interest rates, benefits, and eligibility criteria. This transparency aids potential clients in making informed decisions quickly. Moreover, well-implemented schema markups lead to rich snippets, which can significantly increase click-through rates. They provide a competitive edge by making financial products stand out in a sea of generic search results. Accurate and comprehensive product data also helps in building trust with the audience. In essence, Financial Product Schema Markup is not just about enhancing visibility; it’s about presenting financial products in a user-friendly and accessible way, thereby attracting and retaining informed customers.

Take a look at this FinancialProduct schema:

<script type=”application/ld+json”>

{

“@context”: “https://schema.org”,

“@type”: “FinancialProduct”,

“name”: “Term Life Insurance”,

“description”: “XYZ’s life insurance package covers financial liabilities.”,

“offers”: {

“@type”: “Offer”,

“offeredBy”: “http://www.xyzins.com/life-insurance/”

}

}

</script>

4. Exchange Rate Specification Schema

The Exchange Rate Specification Schema is pivotal for financial services dealing with currency exchange. This schema allows these services to display up-to-date exchange rate information directly in search results. It’s particularly beneficial for international businesses and travelers seeking accurate currency exchange rates. Financial websites can provide essential data like current exchange rates, historical trends, and conversion calculators by implementing this schema. This immediate access to information enhances user experience, as it saves time and aids in quick decision-making.

Furthermore, displaying accurate and real-time exchange rate information boosts the credibility and reliability of the financial service. Having a dynamic and informative online presence is invaluable in a market where currency values fluctuate frequently. The Exchange Rate Specification Schema not only attracts a global audience but also instills confidence in users, making it an essential tool for financial services operating in the international arena.

For more information, visit ExchangeRateSpecification page on Schema.org.

5. AccountingService Schema

The AccountingService Schema is a critical tool for accounting firms and professionals seeking to enhance their online presence. By utilizing this schema, accountants can structure their website data so that search engines can easily understand and display it. This includes services offered, qualifications, areas of expertise, and client testimonials. Such structured data is pivotal in search engine results, providing potential clients with a snapshot of what the firm or professional offers. This immediate access to information not only aids in decision-making but also positions the accounting service as trustworthy and credible. Implementing the AccountingService Schema can increase search rankings and improve visibility, especially for location-based searches. This schema is vital in bridging the gap between accounting services and their potential clients in an industry where trust and accuracy are paramount.

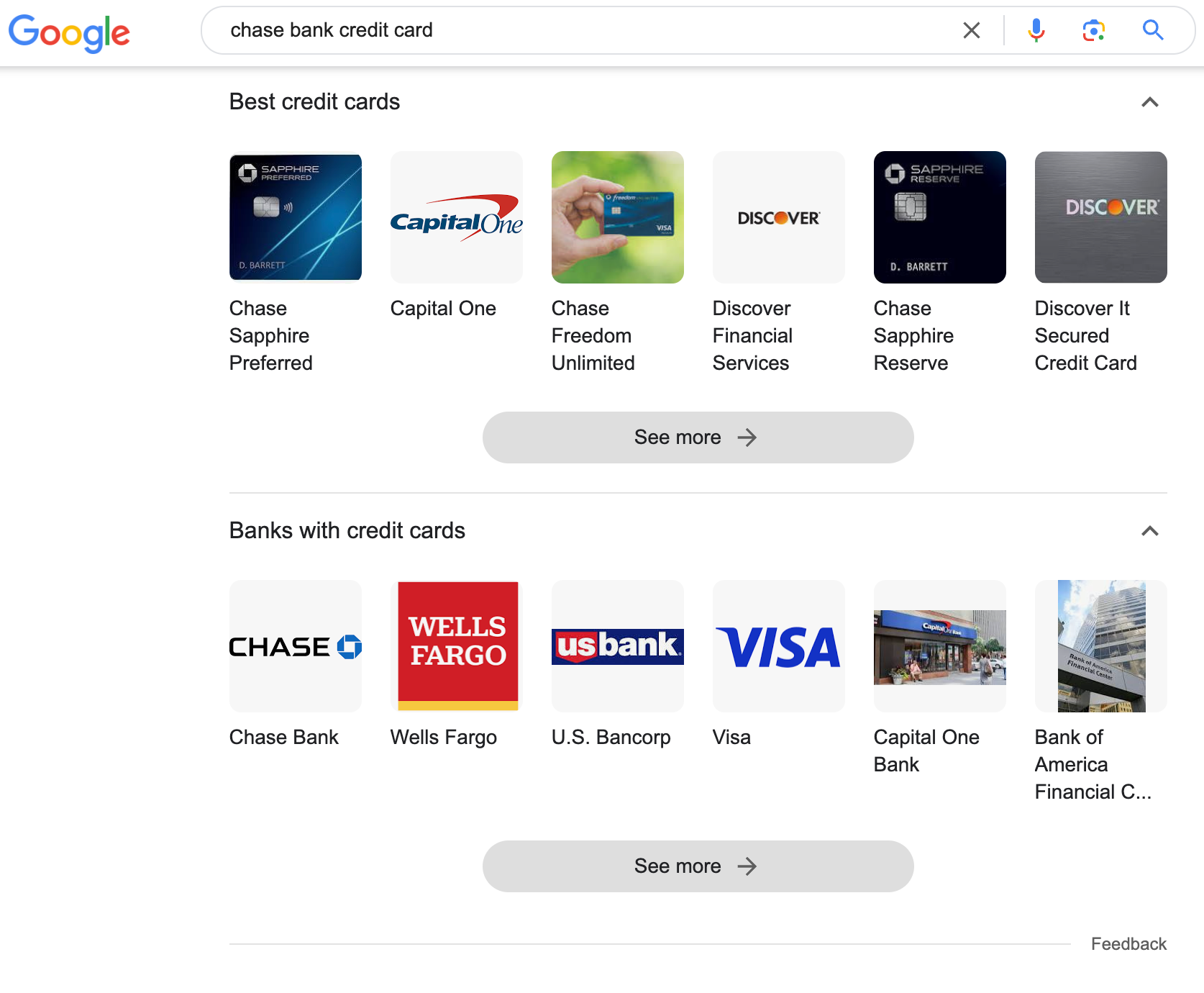

6. CreditCard Schema

CreditCard Schema is essential for credit card providers aiming to enhance their online marketing strategies. This schema allows for detailed information about credit cards to be organized and displayed in search results, such as interest rates, rewards, fees, and eligibility requirements. Such structured presentation helps potential customers understand the product at a glance, fostering informed decision-making. The CreditCard Schema also contributes to improved search engine rankings and visibility. When customers search for specific types of credit cards or credit card-related queries, a well-implemented schema ensures that the most relevant and helpful information is easily accessible. This not only increases click-through rates but also enhances user experience. In a competitive financial market, CreditCard Schema provides a significant advantage by presenting complex product details in an easily digestible and accessible format, catering to the needs of a diverse clientele.

Here you can find a complete example for credit card schema:

<script type=”application/ld+json”>

{

“@context”: “https://schema.org”,

“@type”: “CreditCard”,

“name”: “X Bank Credit Card”,

“requiredCollateral”: “Requires a minimum $1000 security deposit.”,

“amount”: {

“@type”: “MonetaryAmount”,

“minValue”: “1000”,

“maxValue”: “10000”,

“currency”: “USD”

},

“offers”: {

“@type”: “Offer”,

“offeredBy”: {

“@type”: “BankOrCreditUnion”,

“name”:”X Bank”

},

“priceSpecification”: {

“@type”: “UnitPriceSpecification”,

“price”: “50”,

“priceCurrency”: “USD”,

“referenceQuantity”: {

“@type”: “QuantitativeValue”,

“value”: “1”,

“unitCode”: “ANN”

}

}

},

“annualPercentageRate”: “18.99”,

“feesAndCommissionsSpecification”: “https://xbank.com/credit-cards/terms/”

}

</script>

7. BankAccount Schema

The BankAccount Schema is an invaluable tool for financial institutions to showcase their banking services. This markup provides a structured way to present different types of bank accounts, highlighting features such as interest rates, minimum balance requirements, and other perks. By incorporating this schema, banks can ensure detailed and accurate information about their accounts is displayed directly in search results. This clarity aids potential customers in making informed decisions, enhancing user experience. Additionally, it improves the bank’s search engine visibility, particularly for specific account-related queries. In an industry where customer choice is influenced by detailed information and trust, the BankAccount Schema bridges customers to their ideal banking solutions, thereby improving engagement and customer satisfaction.

8. MoneyTransfer Schema

The MoneyTransfer Schema is crucial for businesses offering money transfer services. This schema allows these services to detail essential aspects of their offerings, like transfer limits, fees, processing times, and available currencies. By implementing this schema, companies can provide users with crucial information at a glance in search results, aiding in transparency and building trust. The MoneyTransfer Schema also plays a significant role in SEO by improving the search visibility for specific money transfer-related queries. In an increasingly digital world where speed and clarity are valued, this schema helps differentiate services, providing a clear competitive advantage. It’s not just about visibility; it’s about providing users with the correct information to make informed choices in the complex world of financial transactions.

The effective use of various schema markups is integral for financial services aiming to enhance their SEO and digital presence. From the detailed representation of financial products and services to providing real-time exchange rate information, these schema types empower financial institutions to convey complex information in a structured and user-friendly manner. Implementing these markups improves visibility in search engine results and fosters trust and credibility among users. In an increasingly competitive digital landscape, financial services that leverage these SEO tools can significantly enhance user experience, attract the right audience, and stay ahead in the dynamic world of finance. The journey of optimizing digital presence is continuous, and these schema markups are key stepping stones toward achieving more tremendous online success and customer engagement in the financial sector.

1. Why Financial Services Need SEO

1. Why Financial Services Need SEO